Crude oil prices skyrocketed to 11-year highs amid Russia’s ongoing Ukraine invasion, but then slashed gains.

Crude oil prices jumped and retreated, along with gold prices. The 10-year Treasury yield surged, moving back to the 2% level.

The Biden Administration announced a U.S. ban on imports of Russian oil, gas, and coal Tuesday as Russia continues its attack on Ukraine. But European allies, who are highly dependent on Russian energy, are unlikely to join the ban. Crude oil futures spiked to 11-year highs, but then slashed weekly gains. The national average gasoline price hit $4.33 per gallon, according to AAA data, the highest on record. Whiting Petroleum (WLL) announced it would buy Oasis Petroleum (OAS) in an all-stock deal that values the new combined company at $6 billion.

So I found a stock that can quickly give us a small return on our investments ( Remember I take profits for most of my stocks at 20% . That is my trading strategy )

MNRL – Brigham Minerals

Brigham Minerals, Inc. engages in the acquisition and managing of a portfolio of mineral and royalty interests. Its portfolio includes basins in the United States, which comprises the Permian Basin in Texas and New Mexico; the SCOOP and STACK play in the Anadarko Basin of Oklahoma; the DJ Basin in Colorado; and Wyoming and the Williston Basin in North Dakota. The company was founded by Ben M. Brigham in November 2012 and is headquartered in Austin, TX.

- The word on The Street in general, suggests a Strong Buy analyst consensus rating for Brigham Minerals with a $31.33 average price target, which is a 22.4% upside from current levels. In a report issued on March 25, Raymond James also maintained a Buy rating on the stock with a $39.00 price target.

- Brigham Minerals’ market cap is currently $1.58B and has a P/E ratio of 24.01.

Things to Watch out for?

- There has been an insider selling and I would be closely watching it.

- I will take profits once it reaches my targets.

Fundamental Analysis

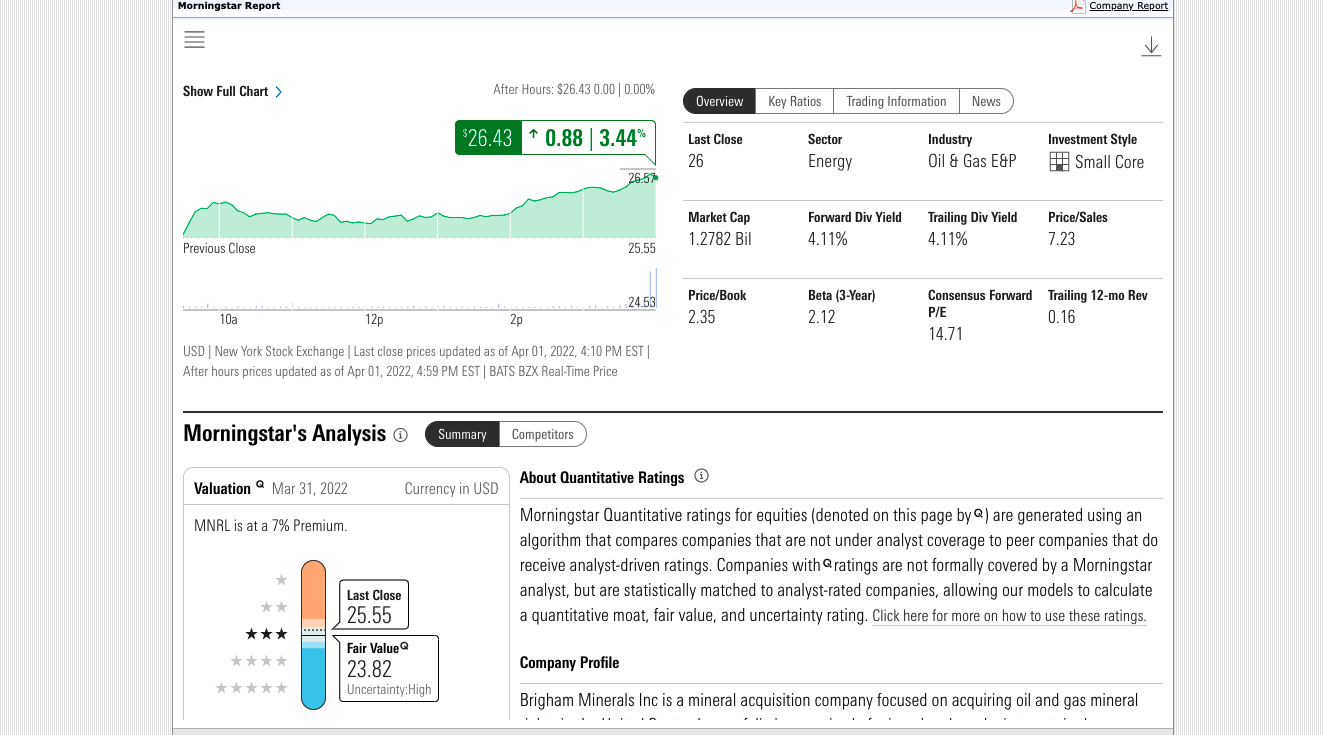

Morning Star Rating :

I ran the Stock in Morning Star and here is what came up. The fair valuation of this stock is around $23.82. But with OIL and Gas , War and Supply chain issues. I am targeting at least a 20% percent profit on my investment on this stock. ( I will wait for it to come down before I initiate the position)

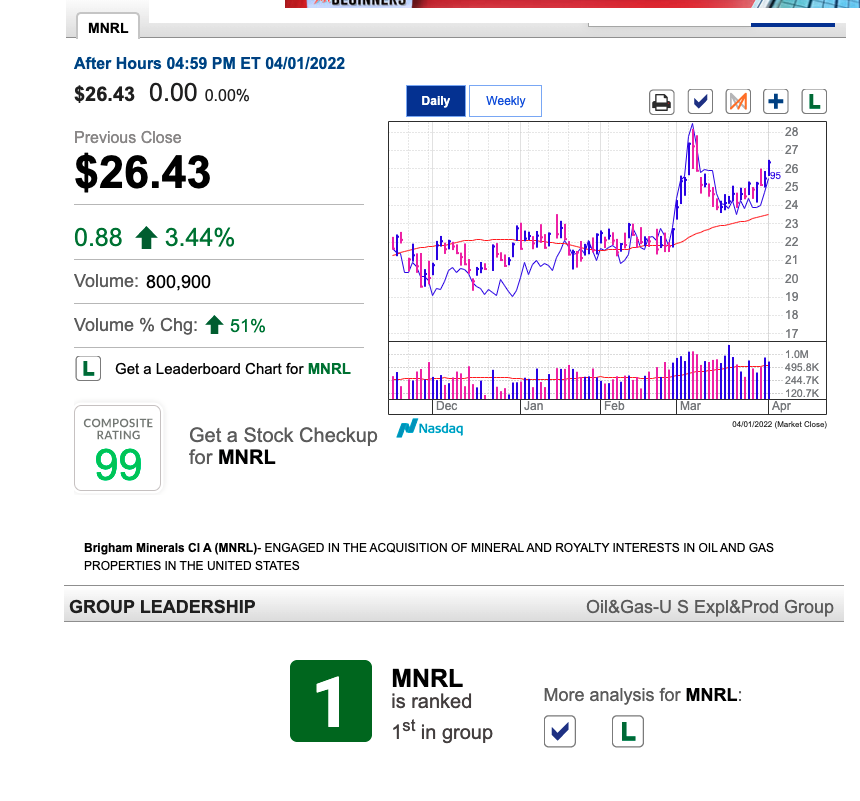

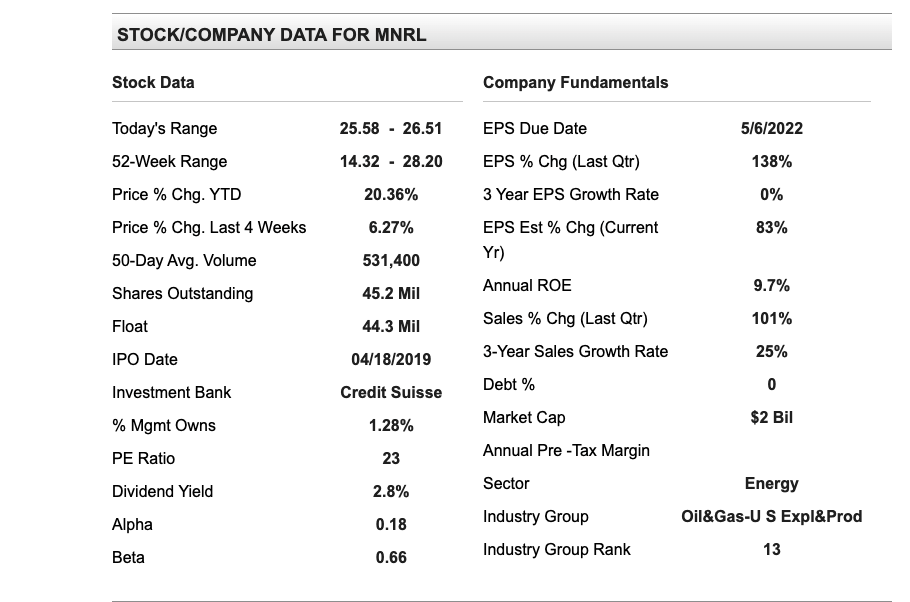

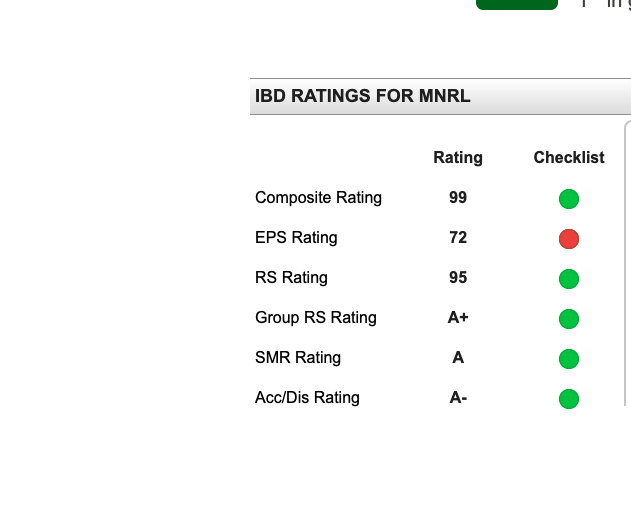

IBD Rating :

I ran the stock in IBD to check its Ratings. Currently, the stock is ranked number 1 in that specific industry group Check the Chart below. The composite rating is around 99 which is highly impressive.

Technical Analysis

Current chart

I will be looking to ride the stock for at least 20% profits. And I might sell after that. But feel free to hold on to it

Analyst Rating :

Tip rank Rating :

I ran the stock on Tip RANKS. And the suggested pricing upside is around $32.20 with a high estimate of $40 and a low of $25.

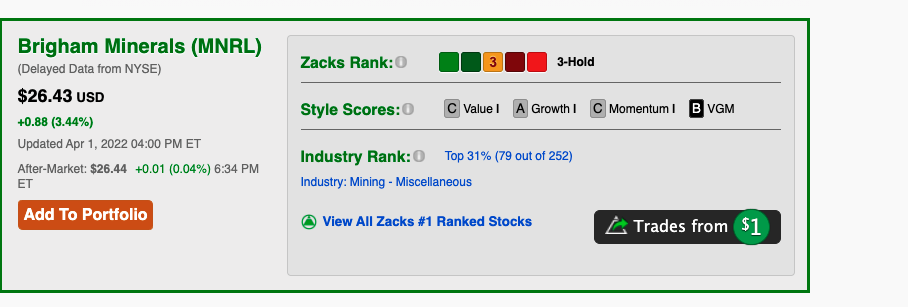

Zacks Rating :

Zacks’s Rating currently has it as a hold.

Disclosure: At the time of writing I do not hold a position in MNRL stock. I have no plans to initiate any new positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. I am not a financial adviser. Please do your own due diligence. I am not a financial advisor.