Shipping

– A few days ago I wrote an article about shipping industry growth and also opened a position in GOGL. I found one more shipping company that I will be opening the position shortly.

Quick update: It’s been a very volatile market in the last few months. We are officially in the bear market. So when you see profits you take them. Even if it is 5-8 %. An interesting trade that I missed last week.

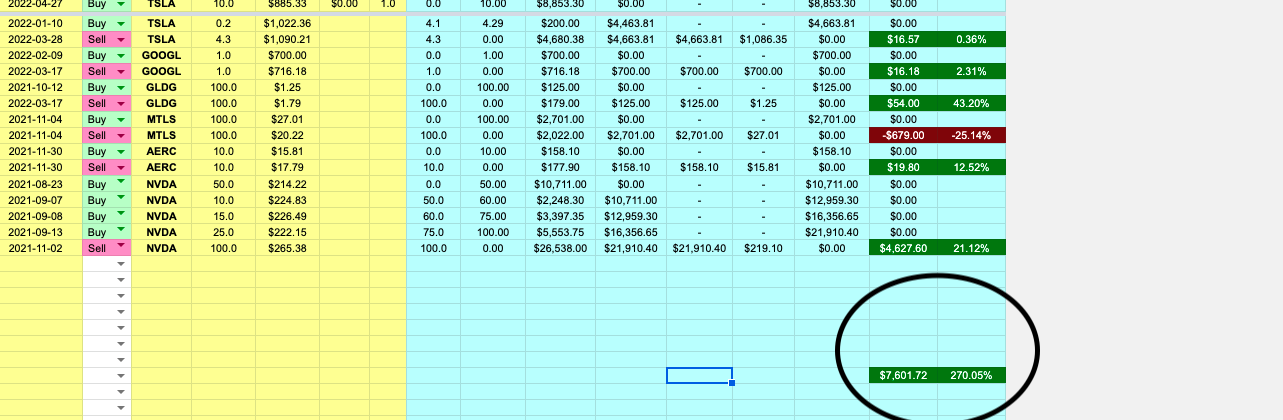

Just before EID, I sold my positions on GOGL, CVE, CRK, and AMR. Collectively my returns from last year October to now are a good 207% الحمدلله. In this duration, I have also traded some small BIO stocks and some Big Names like google, TSLA, and NVIDIA. And also wanted to share with you the costliest biryani that I ate which cost me $299 dollars. On the day of EID, I was watching this stock for break out SSRM. When I was about to open the position it was trading at 20.50. My plan was to sell it the next day for 22 dollars +. The RSI and the MACD at least showed it that it would move. Needless to say, I got busy and forgot to put in the order because of my love for biryani and Viola the next day it did reach the max of $23.49. A 100 stocks of SSRM would have yielded me $ 299 for less than 30 minutes of work. I am closely watching it now and I will enter the position under $18.94 and leave it for 3 months.

Come back to Shipping stock :

Shipping stocks have moved higher for much of the past two years after Covid-related disruptions sent shipping costs higher for businesses importing products and customers paying for them.

Add to it “supply chain challenges in China, primarily due to actions to mitigate the spread of Covid-19, as well as continued supply chain constraints and congestion on the U.S. West Coast, elevated consumption trends, and inventory restocking.”

It also said it expected little to change in the supply and demand backdrop.

Russia will halt gas flows to Poland and Bulgaria, as tankers will be needed to ship incremental gas and coal from North America to Europe.

Oil and gas tanker equities have been strong performers since Russia invaded Ukraine, prompting rounds of sanctions on Russian exports.

EURN – Euronav

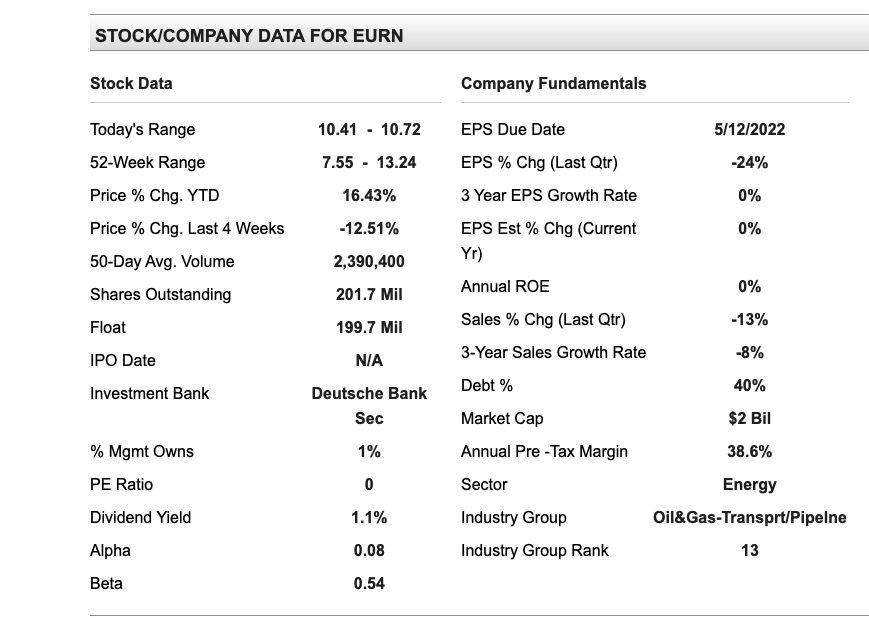

Euronav owns and operates a fleet of vessels for international maritime shipping and storage of crude oil and petroleum products. The company organizes itself into two segments: tankers and floating storage and offloading activities, or FSO. The tankers segment, which generates the majority of revenue, operates crude oil tankers on international markets. The FSO segment conducts floating production, floating storage, and offloading operations for crude oil and petroleum products. The company is domiciled in Belgium, but generates revenue globally.

So why are we bullish on EURN

- This company is expected to earn $0.43 per share for the fiscal year ending December 2022, which represents a year-over-year change of 124.6 %.

-

Two of shipping’s biggest names, Norway-based Frontline Ltd. FRO 0.23%▲ and Belgium’s Euronav NV, EURN -0.76%▼ have agreed to merge in a move that would create one of the world’s biggest tanker owners.

-

The all-stock deal announced a few days ago, which has been approved by both the companies’ boards, involves an exchange of 1.45 Frontline shares for each Euronav share. The exchange will result in Euronav shareholders owning 59% of the merged entity and Frontline investors controlling 41%. ( The deal is not finalized yet)

Fundamental Analysis

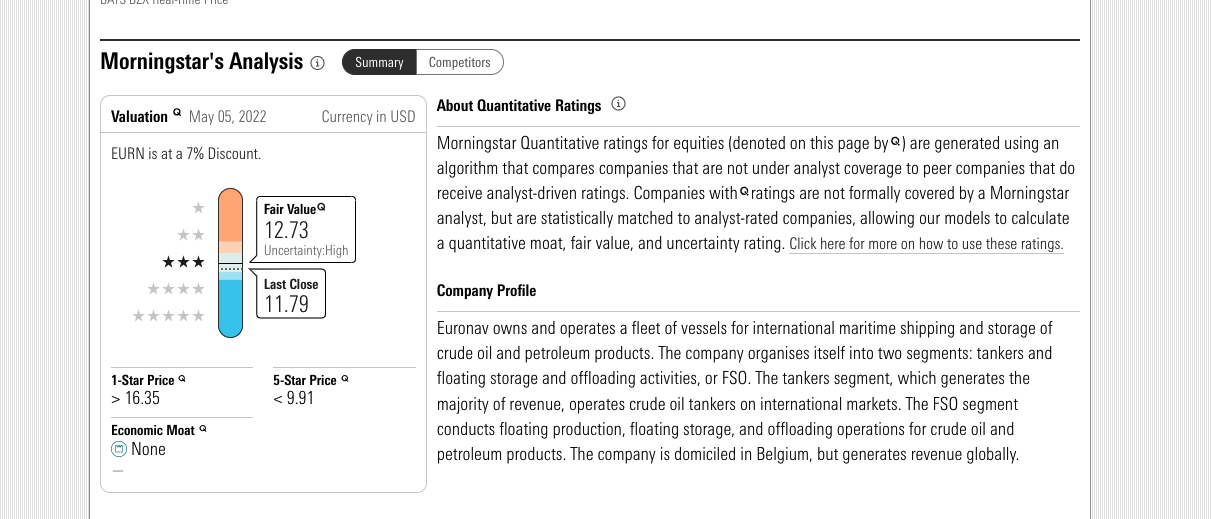

Morning Star Rating :

I ran the Stock in Morning Star and Fair value evaluation came up above the current price. Which is a good sign

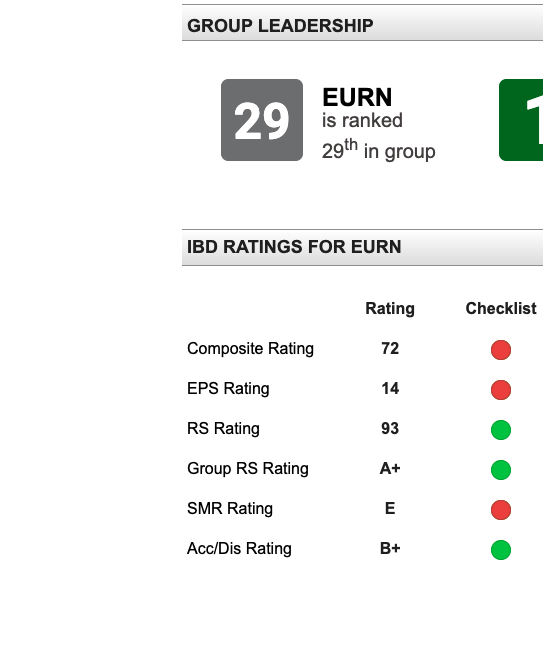

IBD Rating :

I ran the stock in IBD to check its Ratings. Currently, the stock is ranked number 29 in that specific industry group The composite rating is around 98 which is around 72 ( I tend to not trade any stocks which have composite ratings less than 80) But I will make an exception here. EPS is not looking good either but I believe that numbers will improve in the next earnings.

Technical Analysis

Current chart :

My chart Analysis

I did a quick One Day chart analysis. The current Support is $10.12. And the resistance is at $ 11.97. And it is trading right at the 100-day moving average. I would wait for it to bounce off the 100-day moving average before entering a position.

I will be looking to ride the stock for at least 10 -15 % profits.

Analyst Rating :

Tip rank Rating :

I ran the stock on Tip RANKS. And the suggested pricing upside is around $12.50 with a high estimate of $ 13.00 and a low of $12.00

Zacks Rating :

Zacks’s Rating currently has a Buy rating.

Disclosure: At the time of writing I DO NOT yet hold a position in EURN stock. I have no plans to initiate any new positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. I am not a financial adviser. Please do your own due diligence.